When Banks Fail: The Collapse of Silicon Valley Bank

The second biggest bank collapse in U.S. History? Global Bank Indices bleeding? And that is just the tip of the iceberg. The US Banking system is currently facing a crisis, unseen since the days of 'The Great Recession'. This has led to panic among the masses, worried about the safety of their deposits and fearful of a market-wide crisis fueled by a sectoral collapse of global banks. What are the major reasons responsible for the downfall of these banks? And what does the future hold for these distressed banks, capital markets and the general public?

On Friday, 10th March 2023, Silicon Valley Bank, the then 16th largest bank in the US was shut down following a 48-hour frenzy. Just a day before this, the stock price of the bank recorded a 60% single day fall after which trading of the stock was halted. Silicon Valley Bank is the second largest bank to 'go under' since the Washington Mutual Bank. There are various reasons which contributed to the sudden and unexpected collapse of this bank.

For some perspective, Silicon Valley Bank's primary customers were businesses, especially start-ups. In 2021, SVB's deposits went up from $102 billion to roughly $190 billion (approx). As a result, the bank bought over $80 billion in Mortgage-Backed Securities (MBS) for its hold-till-maturity portfolio, with an average yield of 1.56%.

"Hold till maturity" securities are financial instruments held by an investor until they reach maturity, providing a steady income stream and a lower risk investment option. On the other hand, "Available for sale" securities are investments that can be bought and sold at any time, with the goal of earning capital gains or profits. They carry higher risk than hold till maturity securities due to market volatility and their value can fluctuate based on market conditions.

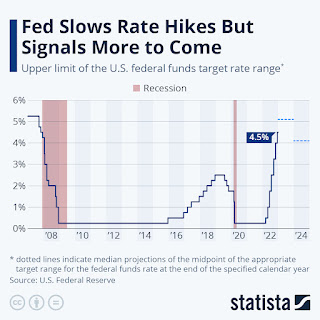

Generally, when interest rates in an economy go up, it has a negative effect on securities, particularly fixed-income securities like bonds. Thus, when the Fed increased repo rates in the country by an aggregate of 425 basis points to 4.5%, it had a negative effect on the bonds and securities markets in general.

So, the value of SVB’s held-till-maturity portfolio (worth $91 billion) dropped to $76 billion. This was not a huge issue as the bank could wait for the securities to mature (most of the securities held, were dated for more than 10 years till maturity) and collect their principal along with the interest. Bad turned to worse when ‘start-up winter’ stuck. During this period, start-up funding, primarily from venture capitalists started to dry off. And due to the high interest rates in the world, start-ups found it hard to get loans at reasonable rates. Therefore, these start-ups started withdrawing money from their bank deposits. As billions of dollars started getting withdrawn, SVB started facing a cash crunch. In order to meet customer withdrawal demands, on 8th March 2023, SVB revealed that it had sold a $21 billion bond portfolio made up mostly of US Treasuries at a loss of $1.8 billion. In order to cover up these losses, SVB tried raising $2.25 billion from its investors in the form of debt and equity.

The bonds that were

being held by SVB carried a coupon rate of 1.56% with a maturity period of 20

years whilst the prevailing bonds with shorter term maturity like 5 years or 10

years were offered for as high as 4%, which led to the investors rushing for

shorter term high coupon rate bonds. In

such a scenario, the investors of old rate bonds (1.56%) had to lower their par

price, i.e., from $100 per unit to $98 or even lower to make then lucrative for

sale. This was exactly what happened

with SVB wherein they sold a bond portfolio at discount to their paid price at

the time of subscribing to those bonds.

This left a big hole in their balance sheet as the portfolio that was

acquired at USD 23 billion was offloaded at USD 21 billion.

This triggered a panic among key venture capital firms and investors, who advised companies to withdraw their money from the bank. This was followed by a 60% fall in the stock price of SVB a day later. By the same day, customers had withdrawn $42 billion, leaving the bank with a negative cash flow of almost $1 billion. The heavy withdrawals even led to the crashing of the bank’s website, further creating panic among its depositors and investors.

The tech startup ecosystem in Silicon Valley has been rocked

by the collapse of the Silicon Valley Bank (SVB). The bank, which had been a

lifeline to many loss-making startups, saw rapid withdrawals as depositors

feared for the safety of their funds. This panic was fueled by the fact that

97% of SVB's deposits came from tech startups, many of which depend on raising

money to pay for their operations. With the FDIC only covering deposits up to

$250,000, the fear was that these startups would lose their lifeblood if the

bank went under.

Unfortunately, this fear became a reality as SVB collapsed, leaving many startups unable to access their funds. This has led to a crisis where several firms are unable to pay their employees, and if the money-returning is further delayed, layoffs and bankruptcies may follow. The CEO of Y-combinator Gary Tan has called this an extinction-level crisis for startups, and warns that it could set their innovation back by 10 years or more.

In response, the FDIC took control of SVB and moved all its deposits to a newly-formed holding bank called the Deposit Insurance National Bank of Santa Clara (DINB). However, this has not stopped the panic from spreading. On March 12, 2023, another regional bank, Signature Bank, collapsed due to increased panic and massive withdrawals after the collapse of SVB.

Multiple regional banks, which used the same banking model as SVB, saw worried depositors piling up to get their money out. The US government and the Fed had to take these drastic measures to avoid bank runs and a cascade of bankruptcies.

However, this does not seem to be a system-wide problem, since larger banks have more diversified portfolios, and the underlying asset, which is long-term bonds, does have some value, unlike the mortgage-backed securities back in 2008, which overnight became worthless.

In conclusion, the collapse of SVB has highlighted the fragility of the tech startup ecosystem and the importance of having a robust banking system. It has also shown how a crisis in one bank can have far-reaching consequences, leading to a cascade of bankruptcies and a loss of innovation.

.png)